Mortgage discharge

If you’ve paid-off the mortgage over your home and you’ve been advised to have a solicitor remove the mortgage from your title deeds, our digital Mortgage Discharge service can help you today.

We are members of Registers of Scotland’s digital discharge service. This means that we can arrange your mortgage discharge quickly and efficiently.

Discharging a mortgage is a crucial legal process that involves instructing a solicitor to prepare a Discharge document on your behalf. This document signals the full repayment of your mortgage and clears your title deeds to remove any paid-off/expired charges.

It’s important to note that you cannot sell or transfer your property title until the standard security is removed. Failure to discharge your mortgage can complicate future property transactions and access to account details.

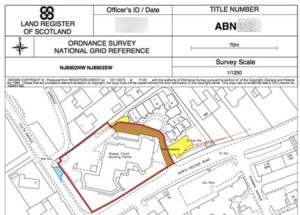

When you instruct a solicitor, we retrieve the title deeds from the lender to draft the Discharge. This document is then sent to the lender for execution, where they formally acknowledge the mortgage’s full repayment. Once the lender returns the executed Discharge, it is registered with Scotland’s land registration body, Registers of Scotland, effectively removing the mortgage from your property.

While discharging a mortgage isn’t an immediate requirement after full repayment, most homeowners prefer to complete this process as soon as possible to secure a clear title to their property.

“Great service from Tim and team when we needed to get standard security of property discharged. Very fast turnaround and super responsive to emails/questions. Would highly recommend.”

Some lenders may offer to store your title deeds for an annual fee, but many solicitors, including us, provide this service free of charge. Storing your deeds with a solicitor mitigates the risk of misplacement, a common issue when kept at home.

However, if you choose to retain your deeds at home and they get lost, registered copies can be obtained if necessary.

If you receive a notification from your lender indicating the impending end of your mortgage term, don't hesitate to contact us. We can guide you through the discharge process, ensuring a smooth transition to a clear property title.

While some lenders may advise keeping a small balance to retain deed storage, our solicitors can assist with the mortgage discharge process.

The majority of our clients opt to discharge their mortgage fully, benefiting from our free storage service thereafter.

We aim to have your mortgage discharge document prepared and submitted to your former mortgage lender within twenty-four hours of your instruction.

Depending on whether or not your former mortgage lender is a member of the Registers of Scotland digital discharge service, the discharge document will likely be signed and returned within a matter of days.

While we wait, we provide you with a completely free title deed review service, where we look at the specifics of your title deeds and provide you with advice on how your property will pass in the event of your death.

If you have not yet made a Will in Scotland, we can provide you with advice and assistance with this too.

To have a chat with us today, call us on 0141 628 5544. You can also contact us via our Enquiry Form or speak with a solicitor at any time (evenings and weekends included) through our Live Chat facility.